mississippi income tax brackets

0 on the first 4000 of taxable income. Ad Find Ms taxation.

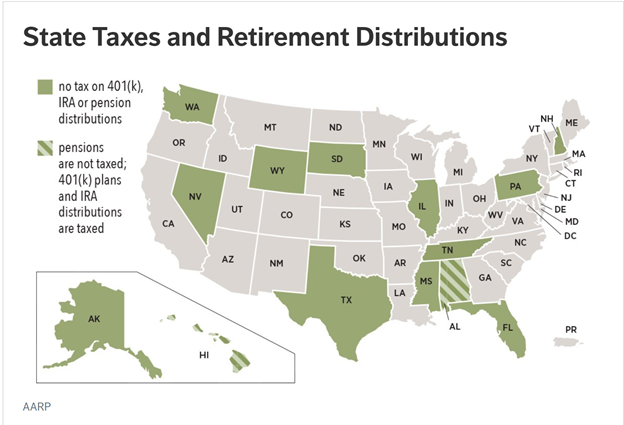

Mississippi Retirement Tax Friendliness Smartasset

Box 23058 Jackson MS.

. 5 on all taxable income over 10000. Mississippi Tax Brackets for Tax Year 2021. STATucator - Filing Status.

Ad Compare Your 2022 Tax Bracket vs. 71-661 Installment Agreement. Mississippis income tax brackets were last changed three years prior to 2019 for tax year.

Mississippi Income Tax Rate 2022 - 2023. Mississippi Income Tax Brackets and Other Information. These rates are the same for individuals and businesses.

2022 Mississippi Tax Tables with 2022 Federal income tax rates medicare rate FICA and. Mississippi collects a state corporate income tax at a maximum marginal tax rate of 5000. 80-107 IncomeWithholding Tax Schedule.

Search For Ms taxation. The income tax in the Magnolia State is based on. 80-105 Resident Return.

80-115 Declaration for E-File. EITCucator - Earned Income Tax Credit. Mississippis income tax brackets were last changed four years prior to 2020.

Your 2021 Tax Bracket To See Whats Been Adjusted. Mississippi state income tax rate. If you are receiving a refund PO.

As you can see your income in Mississippi is. Discover Helpful Information And Resources On Taxes From AARP. If filing a combined return both spouses workeach spouse can calculate their tax liability separately and add the results.

Mississippi has a graduated tax rate. The graduated income tax rate is. Mississippi residents have to pay a sales tax on goods and services.

Mississippi Income Taxes. The Mississippi income tax has three tax brackets with a maximum marginal income tax of. 4 on the next 5000 of taxable income.

HOHucator - Tax Tool. 80-100 Individual Income Tax Instructions. Mississippi residents have to pay a sales tax on goods and services.

The Mississippi income tax has three tax brackets with a maximum marginal income tax of. The state income tax system in. 3 on the next 1000 of taxable income.

80-106 IndividualFiduciary Income Tax Voucher. 80-160 Credit for Tax Paid Another State. 80-155 Net Operating Loss Schedule.

80-108 Itemized Deductions Schedule. Mississippi has a graduated individual income tax with rates ranging from 400 percent to 500.

Mississippi State Taxes 2021 Income And Sales Tax Rates Bankrate

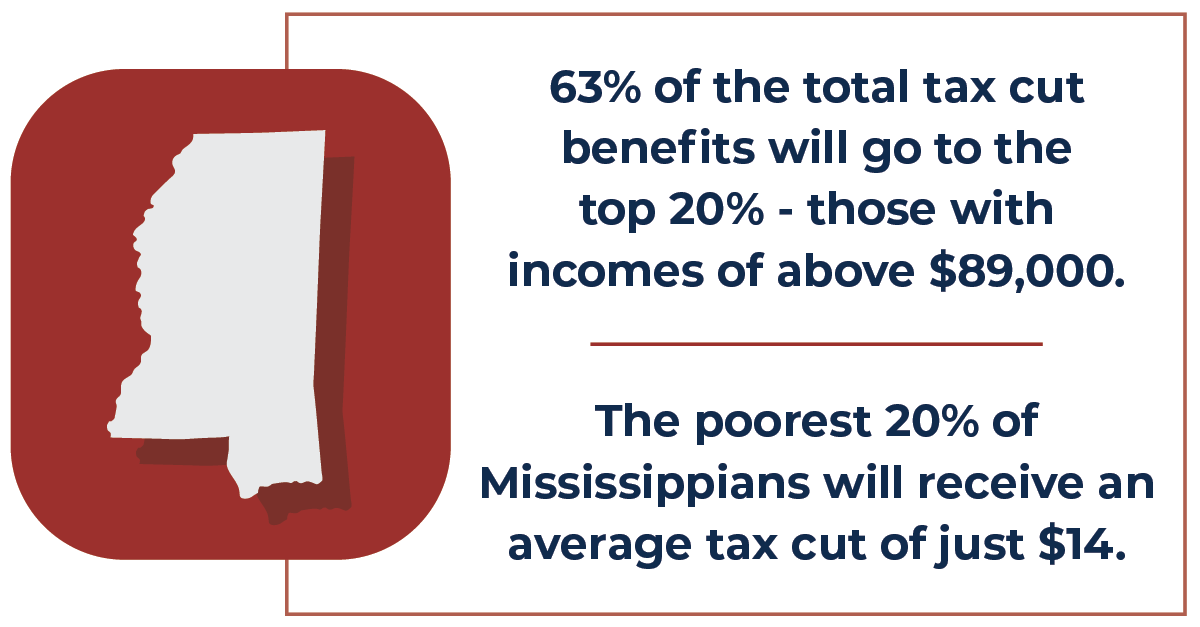

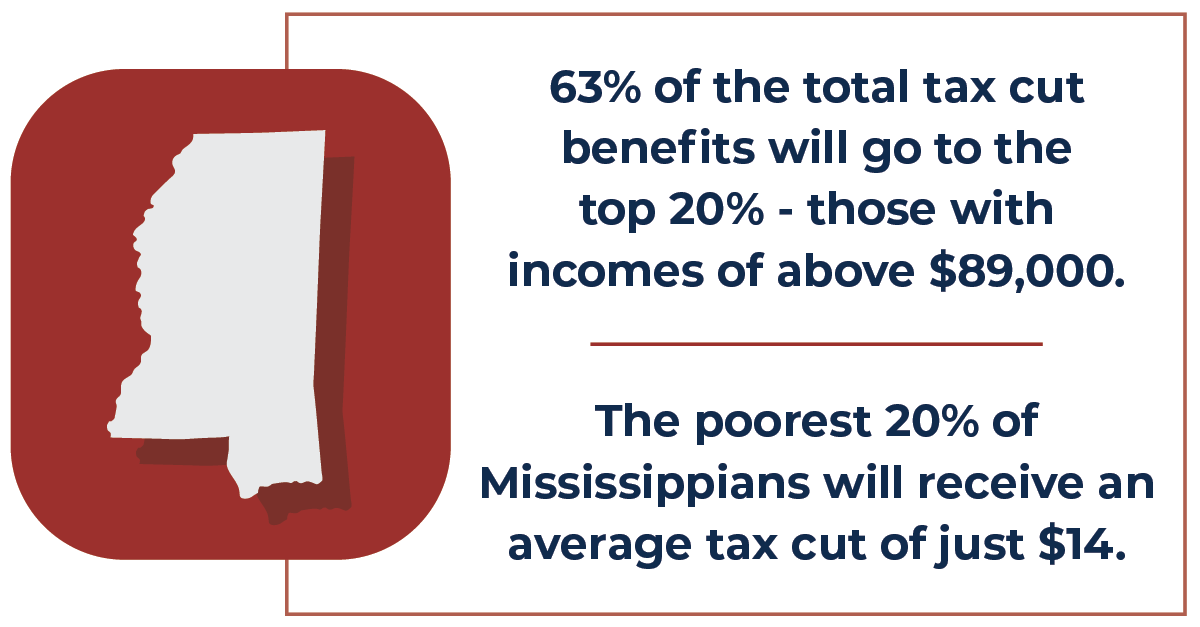

Creating Racially And Economically Equitable Tax Policy In The South Itep

Mississippi Tax Rate H R Block

Mississippi State Tax H R Block

![]()

Mississippi Paycheck Calculator 2022 With Income Tax Brackets Investomatica

Mississippi Tax Rates Rankings Ms State Taxes Tax Foundation

How To Form An Llc In Mississippi Llc Filing Ms Swyft Filings

It S All About The Context A Closer Look At Arkansas S Income Tax Arkansas Advocates For Children And Families Aacf

Gov Reeves Signs 524 Million Tax Cut As Funding Woes Remain

Top Income Tax Rate Dips To 5 9 Arkansas Democrat Gazette Nw 1 1 2021

Moneywise Kansas 3rd Worst State For Taxing Retirees Kansas Policy Institute

State Income Tax Brackets Charted Tax Foundation Of Hawaii

Speaker Gunn Rolls Out Graphic Comparison Of House Vs Senate Income Tax Cut Proposals Mississippi Politics And News Y All Politics

Mississippi State Tax Tables 2022 Us Icalculator

Prepare Your 2021 2022 Mississippi State Taxes Online Now

State Tax Levels In The United States Wikipedia

Every State With A Progressive Tax Also Taxes Retirement Income

Most States Used Surpluses To Reduce Taxes But Not In Sustainable Or Progressive Ways Itep

National And State By State Estimates Of President Biden S Campaign Proposals For Revenue Itep